By Hazel Henderson

©2020 Hazel Henderson

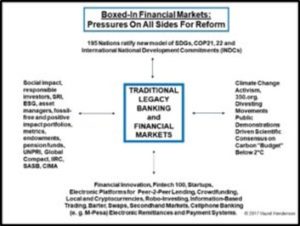

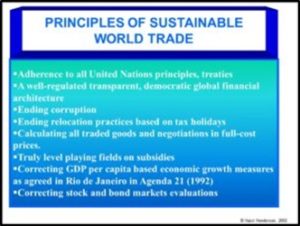

Markets evolved from early individual and community bartering in villages and town squares, then to currency-based trading, national stock exchanges and today’s global satellite and internet-based 24/7 electronic trading and financialization. Few recognize that today’s global financial markets are based on taxpayer-supported public investments in R& D, the internet, fiber optic cables laid under oceans, satellites developed by NASA, as well as all radio, TV, Wi-Fi, and other communications using the publicly-owned airwaves. We drew attention to this rarely-acknowledged debt to taxpayers and how this requires higher standards of all financial markets in the public interest, in our 2010 Statement on “Transforming Finance“ signed by some 100 concerned financial professionals. Today, the pandemic and climate change are driving markets beyond money-metrics and “Transitioning to Science-Based Investing”. While money is exposed as a tool of power in “Fixing the Money Meme”.

As markets expanded in 18th century Britain and Europe, the societal patterns they influenced were mapped approvingly by Adam Smith in his “Wealth of Nations” (1776) as being guided by a benevolent “invisible hand“, along with his earlier caveats in “The Theory of Moral Sentiments“ (1757) in which he stressed the need for ethical interpersonal relations and regulatory oversight by societies in the public interest. Karl Marx weighed in with his “Das Kapital”, (1867), a widely-influential, dour overview of markets’ oppression of workers and international forms of domination he labelled “capitalism“, driven by increasing accumulation , hoarding and enclosure of common global resources. Debates on the role of markets versus the state, individual roles of workers and citizens in democratizing societies continue to this day.

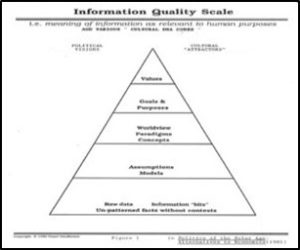

In the 20th century, two world wars and a Cold War were fought over how industrial societies and markets would evolve. The Bank of Sweden lobbied the Nobel prize committee to set up in 1970 its new prize in economics — attempting unsuccessfully to justify this profession as a science. Ideological forces positioned themselves along an imaginary horizontal line from left to right (using terminologies including: communism, socialism, capitalism, fascism, authoritarianism, totalitarianism, libertarianism, populism and anarchism. This 20th century LEFT-RIGHT visualization still dominates political discourse today. It still obscures how actual societies have differentiated into a complex spectrum of views, roles, based on evolving technologies, markets, institutions, education, migration and geographies. (see Paradigm Shift in European Elections).

All these exponential changes have left economic textbooks, financial courses and MBA curricula based on linear static equilibrium far behind, as described in “Planet Before Profit”, Bloomberg BusinessWeek, Nov. 11, 2019. In this new century’s Information age, traditional stock markets are at last focusing on trading itself as excessive, too fast, as in HFT and computer driven algorithmic portfolios, index funds, ETFs and robo-investments and advisors. Science-denial in trading and speculating still ignores real world risks to societies; inequality, pollution and climate change. Commodity markets’, speculation, including for monocultured food grains, have led to poverty and exacerbated hunger and malnutrition in many countries. Many stock markets are now little more than passive investment platforms for trading between market players of secondary assets, rather than acknowledging the new global threats, widening inequality and the needs for providing funds for real economies on the ground. Macroeconomic statistics exclude other scientific data on global conditions as they view the world from 60,000 feet, providing little understanding of the lives of people in “flyover country”. This GDP-driven global growth has exacerbated much regional and local inequality which led to recent so-called “populist” revolts in many countries, as well as the adoption in 2015, by all United Nations (UN) member countries of the more systemic steering metrics of the Sustainable Development Goals (SDGs). (see also “Steering Societies From GDP’s 7 Deadly Sins to the SDGs Golden Rule).

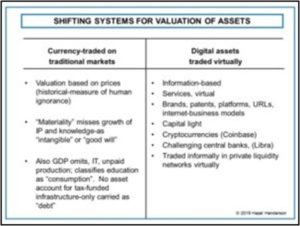

The global COVID-19 pandemic is teaching about exponentials and accelerating change in all sectors. Many see the need for reforming incumbent markets and favor government credit to support new greener markets, community cooperatives, credit unions and home-grown local economies embedded in their environments and the society. Many also advocate recognition of all unpaid caring work, which in most countries is the uncounted up to 50% of all productive work in their societies “Love Economies” (Henderson, 1981). Textbook economic theories are further challenged by digitization, and the shift to service economies, digital assets, patents, copyrights, brands, domains and electronic barter. These intangible values, including unpaid care and volunteering, are still uncounted by most economists and accountants, who still focus on tangible goods you can drop on your foot. This shift to “weightless” economies and “capital-light” start-ups is described in “Capitalism Without Capital: The Rise of the Intangible Economy“, by J. Haskel and S. Westlake, (2018). These massive transitions including

The Silicon Valley giants’ business models relying on advertising are now challenged from many directions for their ever-deeper incursions into users’ privacy, manipulating personal behavior and addicting our children in the newly-diagnosed: “Gaming Disorder” and digital attention deficit disorders. These “engagement algorithms” designed by psychologists and Stanford University’s Persuasive Technology Lab, focus on emotional arousal, offering ever more sensational stories as clickbait to keep outraged or obsessional viewers glued to their screens. Psychographic targeting of specific audiences as likely buyers or voters use MRIs and deep psychological research, such as that of Cambridge Analytica on Facebook, were used by the Trump campaign in the US 2016 elections, but were initiated by the Obama campaign and Google in the 2012 election. This kind of manipulation of voters, along with “fake news” and Russian bots influenced Britain’s Brexit referendum and is now widely used in many democratic countries. These election strategies are detailed by Kathleen Hall Jameson “Cyberwar: How Russian Hackers and Trolls Helped Elect A President: What We Don’t, Can’t and Do Know”, (2018).

I experienced these kinds of Orwellian campaigns for passive acceptance of technological inevitability in my service as a science policy advisor to the US Office of Technology Assessment (OTA), as our reports upset powerful interests. The OTA was shut down in 1996 by incoming Republican congress members. OTA may soon be revived by Democrats in 2021. A deep battle is being fought over the internet at the International Telecommunications Union (ITU) in Geneva, between the USA, China and Russia (see Restoring Net Neutrality)and as pointed out by A. Klimberg in the Darkening Web and Malcolm Nance in the Plot To Hack America, (2017). The original promise of the internet was of providing an open public forum and information source for all, advancing individual participation and global connectivity. In the USA, allocation of domains was initially overseen by a volunteer group, ICANN, (Internet Company for Assigned Names and Numbers). Now ICANN, a non-profit, dominates internet governance and is challenged for recently allowing the sale of the non-profit .org domain to a private equity group, as reported by Jacob Malthouse in The Nonprofit Community is about to lose $90+ Million Dollars a Year.

How will all these current debates evolve markets in new directions? Digital assets traded over the internet globally along with many electronic barter platforms are further displacing traditional currency-denominated asset valuation on stock markets. Unpaid productive work, long ignored in GDP, along with its missing asset account to record the value of taxpayer-funded infrastructure, R&D and support for startup businesses are finally creeping into mainstream statistics. The UN Human Development Report’s Human Development Index (HDI) found in 1995 that $16 trillion of valuable unpaid work was simply missing from global GDP of $24 trillion. If this unpaid production in all societies ($11 trillion by the world’s women and $5 trillion by men) had been included, global GDP for 1995 would have increased to $40 trillion (www.undp.org).

The unacknowledged taxpayer contributions in R&D and assistance to the private sector for most Silicon Valley giants, is documented by economist Mariana Mazzucato in “The Entrepreneurial State” (2013). Brazil’s insistence that the IMF added to its GDP figures the taxpayer investments in its urban infrastructure, airports, sanitation, universities and hospitals, substantially lowered Brazil’s apparent debt-to-GDP ratio — with the stroke of a pen! These omitted statistics missing from GDP were examined in 2003 at the First International Conference on Implementing Indicators of Sustainability and Quality of Life (ICONS) in Curitiba, Brazil, with over 700 professional attendees from statistical offices around the world (“Statisticians of The World Unite! IPS, 2003).

Economists are still dominant policy advisors in too many governments, in spite of their abject failures to foster more equitable, sustainable economies, or to predict financial crises, including the 2008 meltdown (predicted by many including this author, from other disciplines). Yet all their economic textbook theories have been invalidated by scientific research in thermodynamics, biology, ecology, psychology, anthropology and systems models, as I summarized in “Mapping the Global Transition to the Solar Age: From Economism to Earth Systems Science, Foreword by NASA Chief Scientist Dennis Bushnell, London, (2014). Robert Skidelsky author of the masterwork on Keynes, confirms this denouement of the economics profession’s pretensions to scientific status, in “Money and Governments: The Past and Future of Economics” (2019). Many others have documented economists’ specious use of mathematics to camouflage their untenable, obsolete assumptions, as also described by David Graeber in his review of Skidelsky’ new book in the New York Review of Books, December 5, 2019.

Humans create markets and are constantly reshaping them as technologies evolve and human awareness expands. For example, global gem mining is now unnecessary, yet still destructive to miners and the environment, (Beyond Blood Stained Gems: New Science and Standards, 2015) The growing global market for identical lab-created gems is gradually taking market share (see www.ethicmarkgems.com).

Humans will need to embrace all the planetary realities in tackling climate change and other global problems arising out of our limited cognition. We are acknowledging that money is not wealth, but merely a useful informational tracking system for our interactions with each other and natural resources. Currencies are social protocols, information, often as tokens, exchanged on internet platforms with network effects determining their prices, as measured by how many people use and trust them, as I describe in “Money is not Wealth: Cryptos v. Fiats“. Crypto currencies can desist from visual fake images of shiny coins to promote sales, since cryptos are actually strings of digits in computer code. We can also agree that prices are always historical and a function of human ignorance. Like all our markets, prices change as we learn more about our real human condition and future possibilities on this small planet.

**********

Hazel Henderson, Author of” Mapping the Global Transition to the Solar Age” and other books in 800 libraries worldwide in over 20 languages, is CEO of Ethical Markets Media Certified B. Corporation , producer of “Transforming Finance” TV series and publishers of the Green Transition Scoreboard www.ethicalmarkets.com